India’s most popular payment system—Unified Payments Interface, mostly known as UPI—is getting a huge upgrade. Very soon, you won’t need to type your UPI PIN for every transaction you make. Instead, you will be able to pay using your fingerprint or face scan.

The National Payments Corporation of India (NPCI) and Reserve Bank of India (RBI) have confirmed that UPI will now support biometric authentication through your phone’s fingerprint or face unlock feature. This change is expected to take place in different phases, starting this month.

What’s Changing

Until now, whenever you made transactions by sending money or being paid through UPI, you had to enter a 4-or 6-digit PIN. This function works well and is very safe, but it has its downsides. Sometimes, the process can be slow and inconvenient, especially for elderly users or people who forget their PINs often.

So, with the new update, you can confirm payments using:

- Your fingerprint (through your phone’s fingerprint sensor), or

- Face unlock (by using your front camera).

In short, you won’t have to type PINs for every small payment.

This feature was officially launched at the Global Fintech Festival 2025 in Mumbai, where officials said it’s a part of India’s plans to make digital payments “faster, safer, and easier for everyone.”

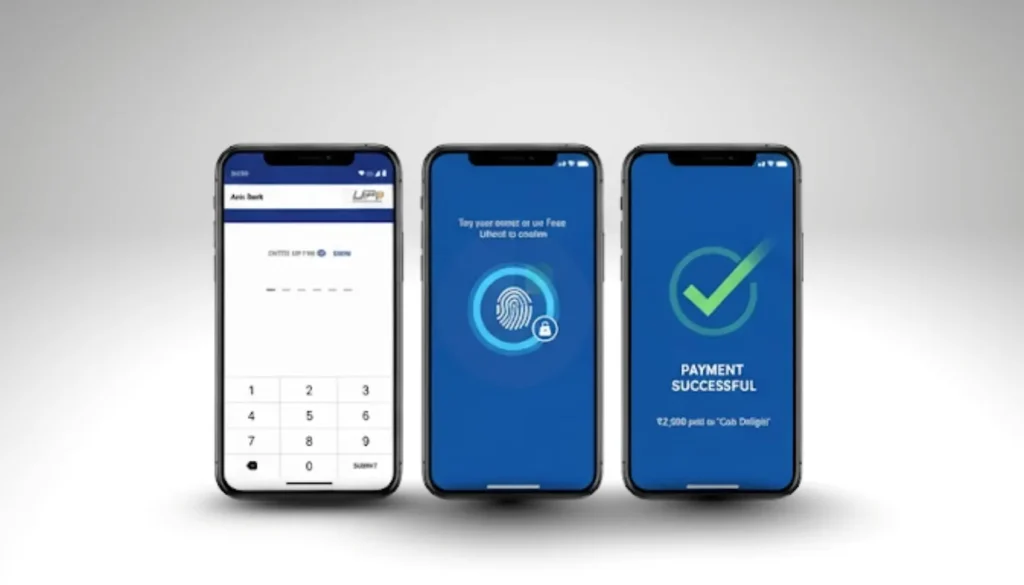

How It Works

Here’s how the new interface looks for users:

- When you make a payment, instead of showing the “Enter UPI PIN” screen, the app will show a biometric verification option.

- You can tap your fingerprint sensor or use face unlock to confirm.

- The payment is made instantly, just like before.

Apps like PhonePe, Google Pay, Paytm, and BHIM UPI are expected to add this option soon. Good thing, this feature will be optional, so users can freely choose between PIN and biometric confirmation as per their preference.

For now, smaller payments (like under ₹5,000) may get biometric approval first. But high-value payments might still need PINs until the system is fully tested to avoid scams or accidental losses.

Read: How October 2025 Rule Changes Will Impact Your Travel, Gaming, Banking, and Investments

Why This Matters

The introduction of this new system could make UPI payments even smoother! India currently records over 14 billion UPI transactions every month, according to NPCI data, and that number keeps growing every day.

Advantages include:

- Faster checkout as users won’t have to remember or type a PIN.

- Easier access for senior citizens and first-time digital users.

- Reduced risk of fraud since fingerprints and faces are harder to steal than PINs.

At the same time, there are still privacy concerns because biometric data is linked to Aadhaar, and experts say the government and banks must ensure that data is encrypted and not stored unsafely.

Challenges

Even though it is a great idea, there are still some challenges that we need to overcome, for example:

- Not all phones support fingerprint or face scanners.

- People might not be so sure about using their biometric data for making payments.

- Connectivity or sensor errors could interrupt the transaction process.

NPCI stated that the biometric feature is optional, and users who prefer PINs can continue using them just as before without any issue.

For Everyday Users

If this feature works as planned, paying through UPI will be as quick as unlocking your phone. Everyday transactions will get easier, as buying groceries, paying for a cab, and sending money to friends can be done with a simple tap or glance.

It’s a huge step for India’s digital economy because making payments is no longer just cashless but also almost effortless.

Final Thoughts

UPI has already changed how India pays, making transactions digitalized, and with this update, even more seamless. A future without PINs sounds very futuristic, but it’s right around the corner.

However, success still depends on how securely and smoothly it is implemented. If it works well, India could once again lead the world in digital payment innovation.

Stay tuned with UpdateMee for more updates on India’s new PIN-free UPI system.